Babylon BTC staking via Crouton Digital

Maximize your Bitcoin's potential with Babylon. Explore advanced staking options that offer rewards without compromising the safety of your BTC. Become part of the future of Bitcoin utility and start growing your assets today.

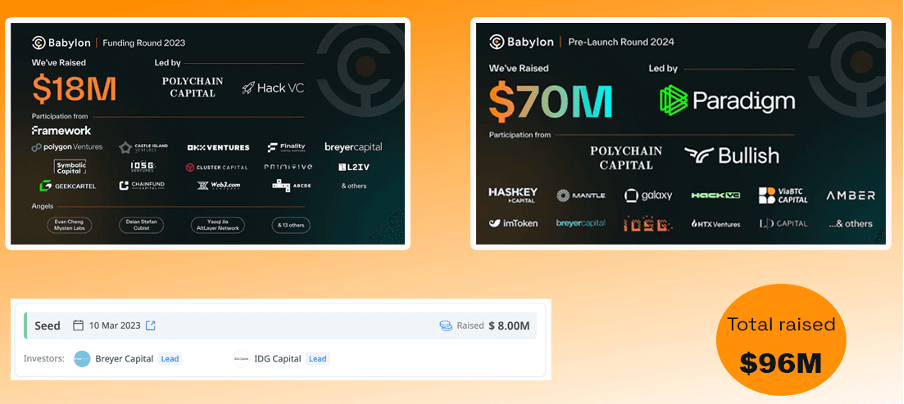

Total funds raised

Babylon has secured $96 million in funding to further its efforts in developing staking solutions for the world's largest blockchain. It is backed by the top tier VC in crypto space such as Polychain Capital, Paradigm, Hashkey IOSG Ventures, Binance Labs, Hack VC Framework Ventures, Polygon Ventures, Castle Island Ventures and OKX Ventures.

About Babylon

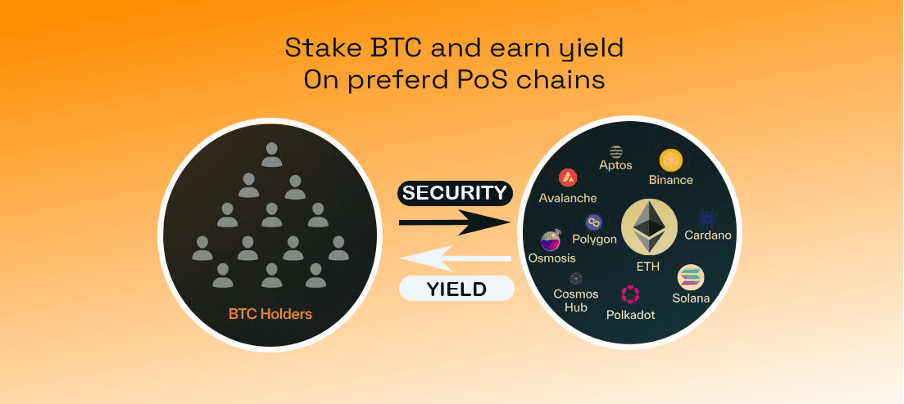

Babylon is an innovative protocol designed to extend Bitcoin's security to improve Proof of Stake (PoS) systems. Babylon's trustless and self-custodial Bitcoin staking protocol marks the third major use case of Bitcoin beyond the storage of value and simple payments.

It introduces Bitcoin staking, enabling holders to secure PoS chains while earning yields, without the need for bridging or wrapping assets. Babylon's trustless protocol offers a seamless and secure way to stake Bitcoin directly on PoS chains, marking a major step toward integrating Bitcoin's security with the scalability of PoS ecosystems.

Proof-of-Stake (PoS) chains require significant capital to ensure security, while Bitcoin, a $1 trillion+ asset, often remains idle. Babylon creates a win-win solution by allowing Bitcoin holders to earn rewards while enhancing the security of PoS networks.

When staking, you don't send your BTC to a third party, instead, it is locked in a self-custodial Bitcoin staking script that you control. This means only you have the authority to unbond the stake and withdraw your funds.

Babylon strengthens Proof-of-Stake (PoS) chains by sharing Bitcoin's security through timestamping. This process, pioneered by co-founder David Tse, submits PoS block hashes and signatures as transactions on the Bitcoin blockchain, embedding an immutable timestamp. By anchoring PoS data to Bitcoin, Babylon enhances its security and immutability, making it harder for attackers to manipulate the data. In the event of an attack or fork, PoS chains can revert to these secure checkpoints, making such attacks more costly and less likely to succeed. Users can also verify timestamps against the Bitcoin blockchain for added legitimacy.

You can learn more about key properties here

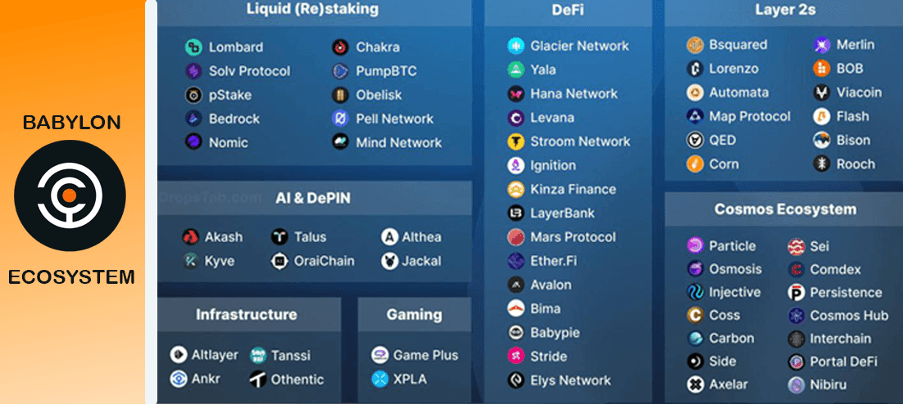

Current Ecosystem

https://babylonlabs.io/ecosystem

Babylon Mainnet launch Phase 1

Mainnet will begin with a points system for staking Bitcoin to a specific finality provider. This phase involves locking only, without a PoS chain, meaning there are no specific staking rewards from PoS networks. Instead, participants will earn points, which are expected to be converted into airdrop tokens at a later stage, similar to the approach recently seen with Eigen Layer (airdropping 15% of the total supply of EIGEN tokens over multiple seasons).

As the network moves into Phase 2 and beyond, your Bitcoin will generate rewards based on its role in securing the PoS systems, enabling you to earn value from your staked assets.

Cap-1 stats (completed)

- 1,000 BTC cap filled in 6 blocks (~74 mins)

- 12.74K unique staker addresses participated

- 20.61K staking transactions processed

Estimated staking source breakdown of the 1,000 BTC:

- ~80% from liquid staking token (LST) projects

- ~20% from native stakers

Cap-2 stats (completed)

- Over 22,891 BTC staked in just 1h27m across 12,641 unique addresses

- The staking dApp saw over 2 million visits during the 10-block duration cap

- Access was equitable, with staking sizes ranging from the minimum 0.005 BTC (3,845 transactions) to the maximum 500 BTC (13 transactions)

- For Cap-2, only about 1.56 BTC in total fees were paid, all going to miners

- That's a fee ratio of 0.0068%, a huge drop from Cap-1's 5.0%

- Cap-2 saw an overflow of 128.97 BTC with less than 0.05 BTC paid in transaction fees for these overflow transactions

- The overflow ratio was just 0.56%, down from Cap-1's 36.9%

- Cap-2 proved to be more efficient than Cap-1

- Over 0.1% of the total Bitcoin supply was staked within just 10 blocks—an incredible feat!

In the Cap-1 staking rules, there was not only a staking hard cap, but also a maximum limit of 0.05 BTC and a minimum limit of 0.005 BTC for each staking transaction. In comparison, the Cap-2 staking removed the staking cap and changed to a "limited time unlimited quantity" staking mechanism, with a staking period of 10 blocks (864790-864799), while increasing the single staking limit from 0.05 BTC to 500 BTC.

What will the rewards rate be on staked BTC?

Points will be calculated per staking transaction and per Bitcoin block.

10,000 points will be awarded proportionally per Bitcoin block (every ~10 minutes).

In Cap-1, due to the 1000 BTC staking cap, the 3125 points generated per block were distributed more significantly according to the staking ratio. For example, if an address staked 0.05 BTC, it could earn 3125 * 0.05 / 1000 = 0.15625 points for each Bitcoin block that passed. The "head mining" benefits were also the biggest reason for the FOMO in Cap-1. However, under the unchanged point distribution mechanism, after the Cap-2 launch, the points generated per block increased to 10,000. If an address still staked 0.05 BTC, it would now earn 10,000 * 0.05 / 22,891 = 0.0209 points for each Bitcoin block that passed.

Phase 1: Bitcoin Locking

In this phase, Bitcoin holders begin locking their BTC via self-custodial staking scripts on the Bitcoin blockchain. Stakers assign a finality provider by specifying their public key, allowing Bitcoin to participate in PoS consensus without transferring ownership.

Phase 2: Bitcoin Staking Activation

Babylon will launch its PoS chain, securing it with the Bitcoin locked in Phase 1. Finality providers with sufficient delegations from Bitcoin stakers will participate in block finality. Bitcoin timestamping ensures cross-chain synchronization and security.

Phase 3: Bitcoin Multi-Staking Activation

Babylon becomes a marketplace for shared security, enabling Bitcoin holders to stake across multiple PoS systems and earn rewards. The Babylon PoS chain will manage staking across different blockchains, leveraging Bitcoin's security across the ecosystem.

Learn more about Babylon mainnet phases here

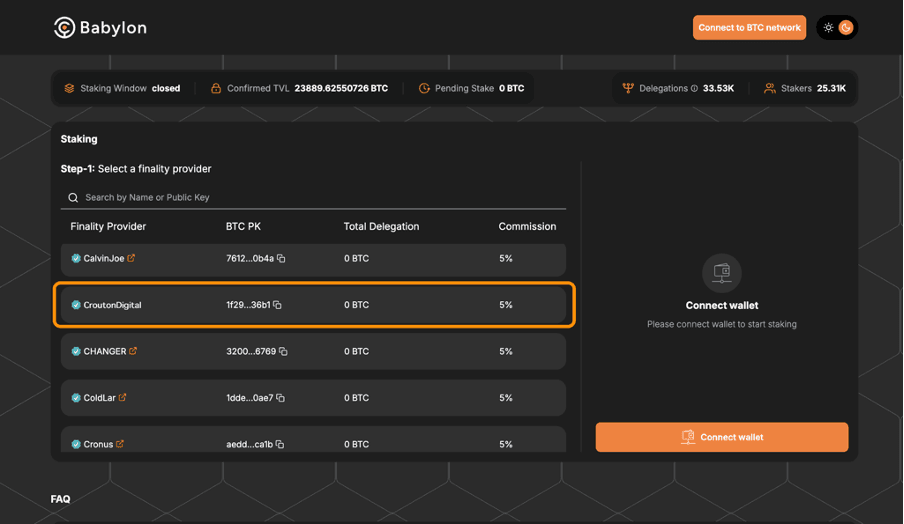

How to stake Bitcoin on Babylon with Crouton Digital?

You can use Babylon's native dashboard https://btcstaking.babylonlabs.io/

To connect your wallet, click the button in the top right corner of the page.

After connecting your wallet, select a finality provider, search for CroutonDigital on the page as shown.

Select CroutonDigital, and follow the on-screen instructions in the dashboard to complete the staking transaction.

Please note, a transaction fee will apply when you submit the staking transaction.

You have the option to either keep the current network fee or speed up your delegation by increasing the transaction fee. Reminder: Setting a higher fee increases the chances of your BTC being staked in the next block before cap ends. If your stake arrives after the cap is reached, it will be marked as "overflow," and you will need to unbond and withdraw your BTC.

Unstaking your BTC

In Phase 1, every stake has a maximum time-lock of 64,000 Bitcoin blocks, or about 15 months. After this period, the stake automatically expires and becomes available for withdrawal.

Stakers also have the option to unbond their stake at any point before expiration. This initiates an on-chain unbonding period of 1,008 Bitcoin blocks (approximately 7 days, as outlined in the unbonding script), after which the stake will expire and be ready for withdrawal.